All fine, but is it a bank or something completely different?

In November 2017, our editors asked in connection with FinTechs and the startup DNA of Challenger banks: What is a completely new type of bank, which is not a bank? Yapeal gives, among other protagonists, an answer to this question, which may turn out differently than expected:

For the people and thus the community, it does not matter in the long term which term is used for something which easily solves all their money and financial management problems. People are increasingly thinking less in bank or non-bank grids - and certainly not in dimensions like FinTech, Neo-Bank, Digital Bank or whatever. These are terms that only occupy us as editors and experts from the financial sector.

People just want "something" that takes on the role of a finance bro, a pay bro, a reliable partner who cares and makes all that is needed right now. Simple, comfortable, versatile, thought-provoking where the user can act flexibly without having to think about technology, configuration, hurdles or limits.

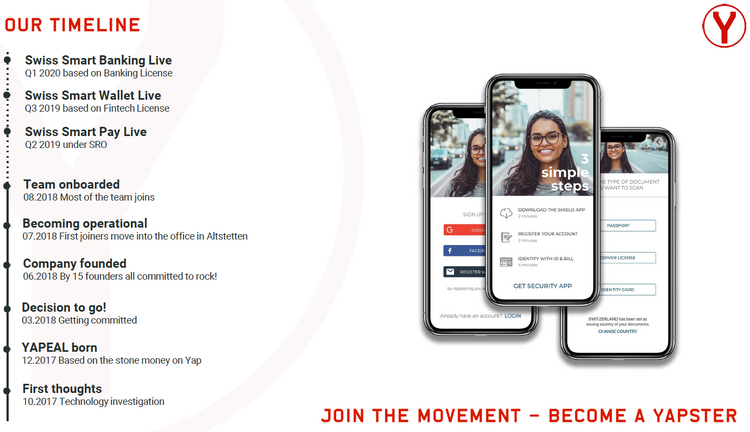

The YapApp is that "something". The user retains the direction and uses what he needs. Yapeal makes it all easy and comfortable. The technological helpers, the algorithms, takes place in the background without the user needing to know about them. YapApp is personalized and always readily available, intuitive, inviting, ready to interact to fulfill the user’s needs.

Therefore, the question is not whether Yapster is a bank or something completely different. It is what the community wishes. And because the community has a thousand faces, it’s what a single user needs right now.